Responsible Lending

City Cash Loans: Payday Loans and Responsible Lending

City Cash Loans is proud to be a responsible payday loans broker. With everything that we do, we always work to keep the following aims in mind:

- We will not encourage customers to take out a pay day loan if we are aware it is not suitable for them.

- We will not aim our advertising directly at people who are have long term financial issues, including those who are unemployed.

- We will not encourage anyone directly to borrow more than they will be able to repay

- We will not charge our customers application fees

On top of that we also:

- aim to give everyone who reads the site a clear, full, understanding of our services

- follow legal and ethical marketing practices

If you feel we are doing anything that doesn’t live up to these aims, please contact us and tell us.

How to choose a payday loan safely

Always look for the contact details for the company you’re applying with. If anything goes wrong, you’ll want to have a phone number or address in order that they can be accountable. Their licence number should also be prominently displayed.

Budgeting

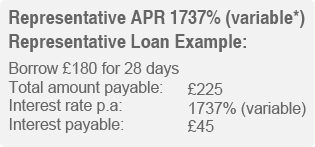

If you haven’t looked at your budget to decide whether or not you can afford a payday loan, you really should. If you won’t have enough money coming in to pay it back comfortably, it could be a much more expensive way to borrow than it is intended to be. You can find plenty of good budgeting information online.

Missed or late payments

If you miss a payment, you may well incur extra charges, although this will depend on the lender. You will almost certainly continue to incur interest on the full amount outstanding, and not just the amount that you borrowed in the first place. We always suggest that you repay in full and on time, as that is the best way to limit the cost of payday loans.

Non-Payment

Each lender will have their own policy on recovering outstanding debts, and this could involve extra fees. We always recommend repaying in full and on time.

Renewal Policy and Rolling over payments

Rolling over payments is sometimes possible. It can help in terms of avoiding penalty charges, but it is highly likely that the interest will continue to grow on the loan amount in the same way as missed payments. Paying back on time and in full is the best way to avoid paying more on your loan.

Repeated loans

You may be misusing payday loans if you are continually taking out more and more, for more money each time. Please consider independent advice and taking a serious look at your budget.

Short term loans

Payday loans are designed to be short term products, and are not suitable to help with long term financial problems. If you’re constantly borrowing to cover normal household expenses, you may be experiencing longer term debt issues.

Where to get advice

There is plenty of free advice available online. We recommend starting at the Citizens Advice Bureau , or the Government debt advice site You can also go to an independent debt advice charity. All of these should offer free advice – do be wary of anywhere that offers to help you with debt in return for a fee.

Customer Services: 0843 5060 182 Mon-Thu 9am-5pm, Fri 8am-4.30pm – Email: [email protected].

CRN: 6617413 – Reg.Office: 28-32 Wellington Rd, London, NW8 9SP, UK – Consumer Credit Licence: 626678/1-Data Protection Reg #Z1696368